In 2023, the oil and gas industry witnessed a staggering $250 billion investment spree through mergers and acquisitions (M&A). What do these colossal deals imply, and how will they impact the oil and gas industry? Navigate through the implications of these colossal deals and their significant impact on the industry’s future with us.

The Oil Industry M&A Landscape

The recent surge in oil and gas industry acquisitions, amounting to a whopping $250 billion, has led major players like Exxon, Chevron, and Occidental Petroleum to secure reserves, notably in the Permian Basin. This consolidation shift emphasizes a strategic move toward bolstering cash flow and controlling expenses rather than focusing solely on production growth. As larger companies tighten their grip, concerns arise about potential ramifications for service providers and pipeline operators, potentially impacting their margins and dynamics. These changes occur amidst rising interest rates, a tightening global oil stock, and a shift toward renewable energy sources, signaling a transformative phase in the industry’s landscape.

Future Projections & Industry Outlook

Projections for the near future indicate expectations of additional oil deals valued at $50 billion or more, while Endeavor Energy Partners, a major Permian shale producer, explores a potential sale that could further concentrate U.S. shale oil output. The consolidation wave, while advantageous for producers, potentially tightens the margins for oilfield service companies and pipeline operators, who now face fewer but more influential clients wielding significant pricing power.

Amidst rising interest rates and a global shift towards renewable energies, this industry shift signals a move from growth-oriented strategies to prioritizing cash flow and expense control. Yet, these transformative changes could create tension between fewer, larger oil producers and governments advocating for a shift to cleaner energy sources. As global oil prices stabilize around $70-$90 per barrel in 2024, this transformative era in the oil industry presents multifaceted challenges and opportunities for various stakeholders.

Implications and Challenges

The consolidation wave among big players, while beneficial for producers, has raised concerns for service companies. With fewer customers wielding greater pricing power, service companies face squeezed margins as existing contracts undergo renegotiation. While expansions to existing lines in the Permian Basin offer some relief, estimates suggest that by mid-2025, pipeline capacity from the Permian will reach 90%, impacting future operations and expansions. Additionally, major oil players face intensified regulatory scrutiny for their acquisitions, potentially impacting deal closings. The emergence of fewer, larger oil producers also raises tension between fossil fuel consolidation and the global push towards cleaner energy sources.

Future Market Projections & Conclusion

Anticipating a stable outlook for global oil prices in 2024, analysts project trading to hover between $70 and $90 per barrel, a notable increase from the 2019 average of $64 per barrel. This projection comes amidst tightening global stocks and a gradual increase in oil output, highlighting a shift in priorities among oil giants toward maintaining financial resilience over rapid production growth.

TLDR:

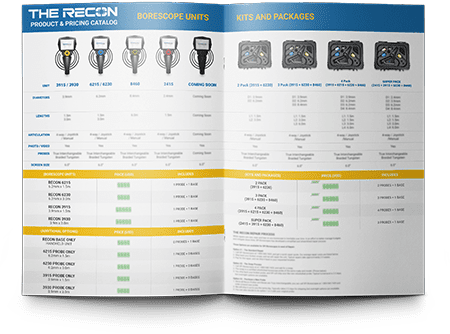

Amidst the dynamic landscape of surging M&A activities in the oil and gas sector, it’s evident that significant changes are on the horizon. Regulatory scrutiny and evolving market projections indicate a transformative journey ahead for the industry. In this evolving landscape, SPI Borescopes plays a pivotal role by providing critical precision inspection equipment. This equipment stands as a cornerstone in optimizing power plant operations, particularly amid ongoing industry transformations. Committed to ensuring reliability and efficiency, SPI Borescopes remains steadfast in supporting the evolving needs of this dynamic sector.